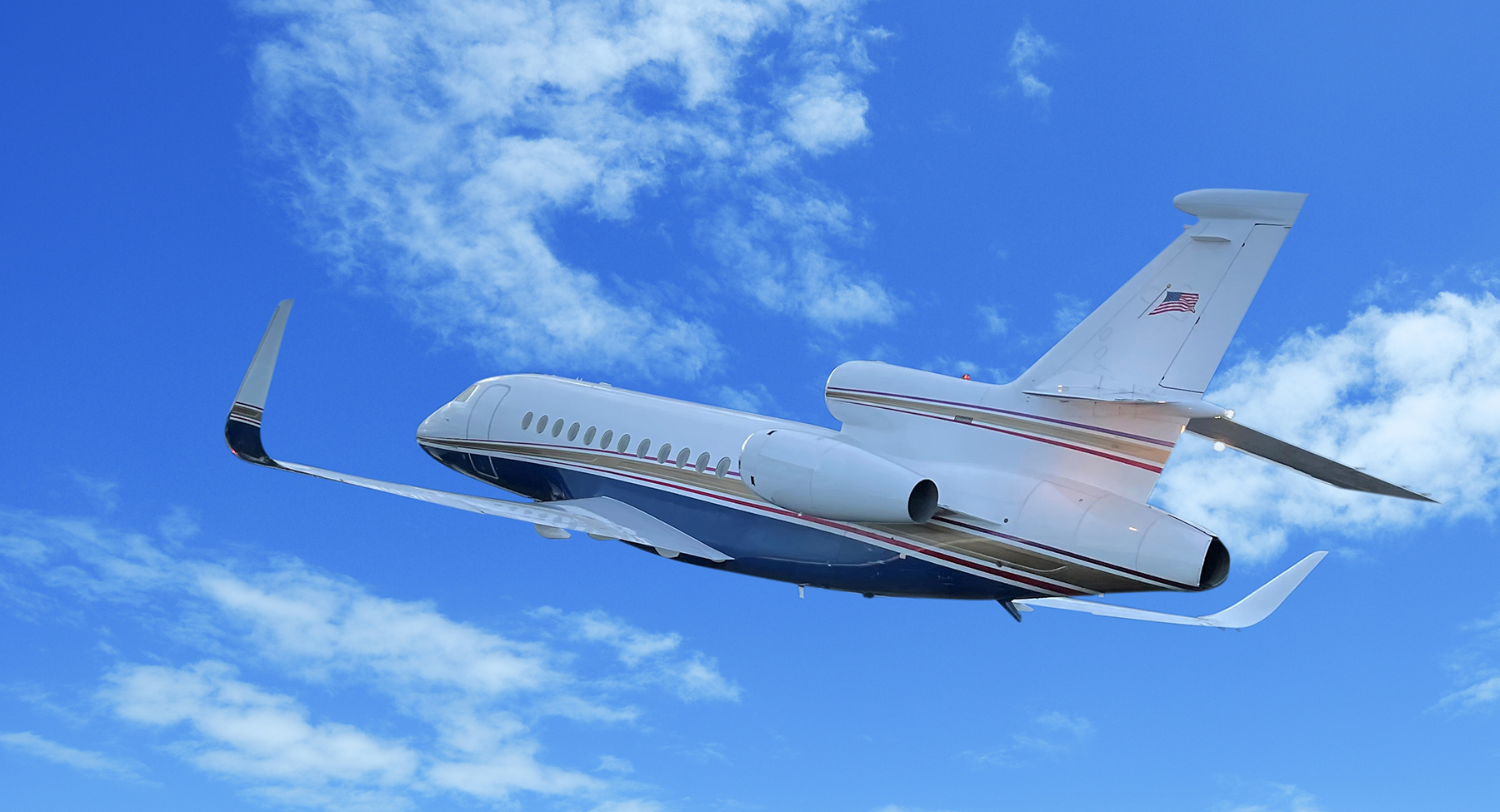

Upgrading your aircraft can lead to significant performance improvements and potential cost savings for ownership. One of the most popular and impactful modifications available today is the addition of winglets. In addition to the immediate flight benefits they provide, winglets offer tax advantages that can help offset the upgrade investment.

Winglets Make the Aircraft

While winglets add style and aesthetic value to the aircraft, their direct benefits are measurable on numerous fronts:

- Increasing Fuel Efficiency – Blended Winglets minimize vortices off the wingtips, reducing drag and fuel burn. On average, Blended Winglet-equipped Falcon and Hawker aircraft save 5 to 7% fuel each flight.

- Extending Range – Fuel efficiency gains on long-range cruise make nonstop east-to-west flights across the country possible.

- Improving Takeoff and Climb Performance – Aircraft climb to cruise altitude 25% faster or more, as well as raising optimum cruise altitude by as much as 2,000 feet,

- Raising Resale Value – Winglet-equipped aircraft sell faster, and at higher resale prices, often being the No. 1 most requested modification for buyers.

Gaining Tax Benefits of Aircraft Improvements

The cost of adding winglets to your aircraft can be substantial, but it’s important to remember that this kind of upgrade is considered a capital improvement. According to IRS guidelines, capital improvements – such as upgrades to your aircraft – can be depreciated immediately or over time, with both cases reducing your taxable income.

In the U.S., the Modified Accelerated Cost Recovery System (MACRS) allows you to depreciate aircraft improvements over a set number of years, typically five years for business aircraft. However, you can accelerate your depreciation under Section 179, which allows businesses to deduct the full or a partial cost of capital improvements, such as winglets, in the first year, rather than spreading it out over several years.

Under Section 179, the aircraft owner may be able to write off up to 100% of the upgrade cost in the year the winglets are installed, provided the aircraft is primarily used for business purposes. This creates a significant tax advantage, especially for businesses that rely on aircraft for operations.

Applying Tax Deductions to Your Aircraft

To take full advantage of these tax deductions, make sure that:

- Aircraft Qualifies for Business Use – The IRS requires that an aircraft be used for business purposes more than 50% of the time to qualify for Section 179 and bonus depreciation. It’s essential to maintain detailed flight logs and ensure that you meet the criteria.

- Winglet Upgrade is Installed and In-Use (Placed In-Service Requirements) – Deductions are only applicable once the aircraft improvement has been completed and placed in service. Ensure that the winglets are installed, and that the aircraft is operational within the tax year to claim the deduction.

Given the complexity of tax laws, it’s advisable to work closely with a tax professional who specializes in aviation to ensure that you’re maximizing your deductions and staying compliant with all IRS regulations.

Upgrading your aircraft with winglets is a smart investment, offering both performance improvements and long-term cost savings. When you factor in the tax advantages of depreciation, the financial case for winglet upgrades becomes even stronger.

Not only will your aircraft fly more efficiently, but you’ll also enjoy substantial tax benefits that help offset the upfront cost of the modification.

Contact Aviation Partners to learn more about winglets and installation for your Falcon or Hawker aircraft. Reach out to Aviation Tax Consultants for more specifics about winglets’ tax advantages or other aviation tax advice.